One of our venture fund managers recently asked, “When you invest, what is a good expected return?” After thinking about the question, we concluded that the answer depends on the type of investment – is it a company or fund, and is it early-stage or late-stage? It is also necessary to account for factors we believe greatly impact returns and their relationship to the ways in which investors underwrite new investments.

Generally speaking, we found that the likelihood of achieving expected returns is not simply a function of high multiples. In fact, it varies depending on risk profile. For direct investments, loss rates and holding periods play a significant role. For venture fund counterparts, the same holds true, but exit strategies – whether through IPO or M&A – and capital-deployment timing also matter a great deal. Beginning with the summary below, we explore the various alternatives and how we think about risk and target returns.

To simplify the analysis, let us first consider direct investments involving two types of venture businesses:

- Start-up firms (i.e., those with less than $1 million in revenue) funded by early-stage venture funds;

- Later-stage companies (i.e., those that have raised capital at valuations greater than $100 million).

As noted earlier, two key factors driving returns for this category are loss rates and holding periods. For the purposes of this article, we define the former as the likelihood of a return that is less than 1x invested capital, and the latter as the duration between the initial commitment and subsequent exit.

Start-Up Firms

In a 2009 blog post, Mark Suster of Upfront Ventures noted that his targeted batting average for early-stage investing is “1/3, 1/3, 1/3.” In other words, he expects one-third of his investments to be a total loss, one-third to return his principal, and the remaining third to deliver the lion’s share of overall returns.

Does Mark’s simple thesis reflect reality? The answer is “Yes.” As we noted in a previous article, “Winning by Losing in Early Stage Investing,” the typical loss rate for early-stage investments is 65% (i.e., two-thirds return less than the initial outlay). This means that 35% must generate gains much greater than 1x to achieve an acceptable overall result.

Our experience suggests that most venture investors seek a 30% gross internal rate of return (IRR) on their successful investments; according to the National Venture Capital Association, the average holding period of a VC investment is eight years. This means an early-stage investor would need to garner 10x plus multiples on the winners to meet his or her IRR target.

With that in mind, it is clear why holding periods and loss rates are important. A longer holding period will, by definition, require that the top third of investments generates a higher aggregate multiple to achieve the desired IRR, and vice versa. A higher loss rate will also boost the return multiples required from the winners to offset the loss-oriented skew.

Later-Stage Companies

Later-stage venture investing typically involves less risk than its early-stage counterpart. Among other things, more mature entities are typically generating significant revenue (though they may still be unprofitable) and have moved beyond the market and product development stages. They are also seen as less risky because the odds of a successful exit are higher. In theory, these investments should have lower loss rates and shorter holding periods.

In fact, hard data bears this out. According to Pitchbook, the loss rate for later-stage companies is less than 30%, in contrast to the 65% number for early-stage counterparts. By the same token, average holding periods are shorter – six years, on average.

Using the same analysis as we did earlier, we find that this segment’s return profile is somewhat different. Late-stage investors, generally speaking, target a 20% plus gross IRR on their winner investments. This means late-stage investors need to make 3x on the winners to achieve their objectives. Given that their investments are generally less risky and closer to prospective exits than early-stage alternatives, the lower multiple makes sense.

Fund Investments

When it comes to fund investments, things are a bit more complicated. What sort of return might an investor expect? As before, it makes sense to evaluate the issue from two perspectives:

- Early-stage venture funds (i.e., those that fund start-up firms)

- Growth venture funds (i.e., those that invest in later-stage companies)

Although the loss rate and holding period criteria noted earlier still apply, determining expected returns for these types of investments are more nuanced. Capital deployment timing, fund lives, expected exit timing and proceeds, and fund fee structure can all impact returns (from an IRR perspective, that is).

Early-Stage Funds

According to Cambridge Associates, net annual returns for early-stage funds averaged 21.3% over a 30-year span (through December 31, 2014). While this is near the IRR target for one-off start-up investments, the variance and risk associated with that return are lower.

For one thing, because there are typically 20 investments – where the average holding represents less than 10-20% of the fund – the downside risk is reduced through diversification. Moreover, because some exits may occur more quickly than the direct-investment average, the fund is exposed to positive cash flow optionality. Simply put, the expected IRR profile appears more reassuring, though the upside potential is less dramatic.

That said, how capital is invested and subsequently recaptured through exits can have a meaningful impact on returns. As it happens, our experience bears this out. To demonstrate the point, we evaluated Industry Ventures’ data on the average pace of capital deployments (i.e., cash inflows as a percentage of fund size) and exits (i.e., cash outflows as a percentage of fund value) across the numerous early-stage funds we committed primary capital to. Because the timing of the commitments varied by fund vintage, we assumed a 12-year normalized life for each fund. We also assumed that uncommitted capital and the unrealized value of assets were distributed equally in the remaining years.

As you can see in the table below, our analysis indicates that the bulk of the capital calls take place within the first five years, while sizeable exits generally do not occur until year eight.

Using this data together with an expected loss rate equal to that of individual early-stage investments, we calculated the performance of a hypothetical $100 million fund with a 2% annual management fee (in the first 10 years) and 20% carried interest. We assumed the fund would be invested in 20 companies, where 65% returned 0.5x and the balance returned 10x. We concluded that our hypothetical fund would likely yield a gross expected return multiple of 3.8x and generate a net multiple of 3.1x, or an IRR of 20%.

As this example shows, various factors can impact expected returns. If 100% of capital had been called in the first three years, IRR would have gone down, but the net multiple would not have changed. Alternatively, if exits had only taken place in the final three years, IRR would also be lower. While diversification significantly reduces the risk of a total loss, estimated expected returns is more challenging.

Growth Venture Funds

For growth venture funds, the situation is slightly different. According to Cambridge Associates, the 30-year average annual net return for late and expansion-stage funds is a more modest 12.6% (through December 31, 2014). This is consistent with the funds’ lower risk profile, which stems, in part, from diversification. That said, the odds that they will witness exits as early as three years out are greater. In other words, though expected loss rates might not change, smaller deployment-exit gaps can have a pronounced effect on expected returns.

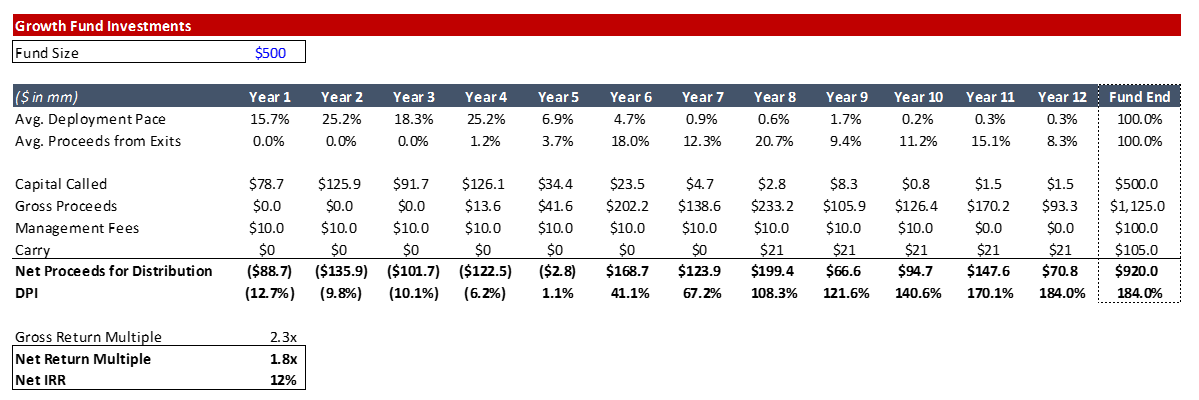

Using the same logic as above to assess the investments we have made in this space – and assuming that 30% of our pool returns 0.5x, while the remainder garners 3x gross – we found that the hypothetical fund generated a approximate 2.3x gross and 1.8x net return, or an IRR of 12%.

As expected, the average growth-stage fund net multiple is below that of the early-stage counterpart and the IRR is lower. Essentially, while the timing of capital deployments is similar, growth-stage funds experienced significantly quicker exits at much lower multiples.

So, what’s the moral of the story? When it comes to venture investing, there can be much more to expected returns than multiples alone.