From Opportunistic to Operational: How VCs are Rewriting the Liquidity Playbook

Introduction

The venture playbook is evolving. After more than three years of muted IPOs and selective strategic M&A, many venture capital firms are building a new muscle: proactive, repeatable portfolio harvesting. Inside large venture platforms, a now‑formal role – part banker, part operator – preps companies for sale, builds buyer maps, and aligns syndicates long before an exit process begins. At the same time, private equity firms have emerged as the natural buyers for many of these companies, offering a differentiated and increasingly viable exit pathway. This marks a cultural shift in venture where exits are no longer just luck or timing but can be achieved through an actionable and repeatable process. In this article, we explore how VCs are adopting a full-court-press approach towards active portfolio management – and why PE is increasingly the counterparty of choice.

Venture Capital’s Liquidity Dilemma: Rewriting the Exit Playbook

While Q2 2025 produced $68B of US venture exits across 394 deals – representing the strongest quarter since late 2021 – this momentum was driven by just a handful of IPOs and several billion‑dollar M&A transactions rather than a broad tide of exit activity.1 Behind the headline numbers, buyer focus skewed earlier: pre‑seed, seed, and early‑stage targets accounted for 64% of H1 2025 acquisitions as they usually have cleaner cap tables and less valuation baggage.2

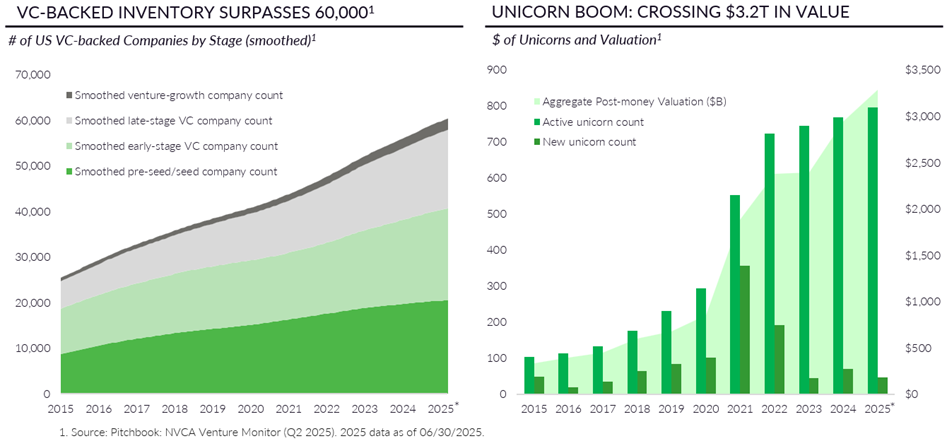

Although the IPO window is slowly reopening, approximately $3.2T of value remains locked in private unicorns.1 Many of the largest unicorns continue to attract strong private demand for both primary and secondary transactions, leaving them with limited incentives to go public. Meanwhile, there are over 60,000 active US venture-backed companies that ultimately require an exit pathway.1 As venture becomes increasingly institutionalized, particularly with the rise of megafunds (VC funds >$1B in fund size), we anticipate a sustained and meaningful expansion in the number of VC-backed companies.

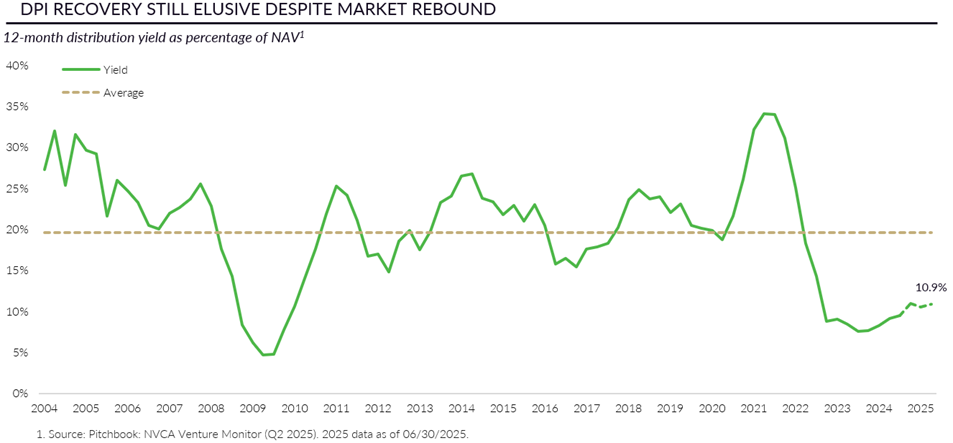

Additionally, fundraising challenges further heighten the urgency to harvest. In H1 2025, US VC funds raised $27 billion across 238 vehicles, with the median time to hold a final close extending to 15.3 months. This represents the longest fundraising period in a decade as LPs demand improved distribution pacing and greater asset‑level transparency.1 Slowed distributions are limiting capital recycling into new funds, which is further compounding the fundraising headwinds.

As a result of the above challenges, venture’s dilemma persists—strong companies stay private, others remain stalled, and all are searching for an exit, encouraging venture firms to re-write their liquidity playbooks.

Operationalized Exits: The Shift to Active Portfolio Harvesting

A growing number of venture firms now treat exit readiness as a continuous process. Internal corporate development teams with banking or private equity backgrounds are quietly tuning metrics and materials, sharpening pricing and packaging, and socializing options across boards.

Minority positions held by venture firms limit any ability to “force” a sale and requires careful navigation of often complex cap table dynamics. Leading firms such as NEA, General Catalyst, Tiger, Lightspeed and Norwest, are hiring experienced M&A specialists focused on driving liquidity for their portfolio companies. At Industry Ventures’ second annual VC liquidity roundtable earlier this month, Laura Boyd, Norwest’s Head of M&A and Capital Markets, highlighted:

“At Norwest, we start thinking about exit planning early. We curate a list of strategic and sponsor partners who we believe will be excited about the company. By keeping them informed on the company’s progress, we ensure that when it’s time to exit, the ultimate buyer is acquiring a business they’ve been tracking and know well.”

This reflects a cultural shift from opportunistic deal-making toward institutionalized portfolio management, where best practices include calendarized buyer outreach, KPI instrumentation (annual recurring revenue (ARR) quality, net revenue retention, customer acquisition cost payback, cash conversion), data‑room hygiene, and scenario planning (recaps, mergers of equals, structured secondaries). Repeatability and readiness processes such as these can help prepare companies to act when exit windows reopen.

Greg Sands, Founder and Managing Partner at Costanoa Ventures emphasized the importance of portfolio management:

“As Venture GPs, our goal is to get the best outcome for our founders and entrepreneurs. We are constantly monitoring the potential buyer base, so when the time is right, we can match our founders with their best next partner.”

Three Practices of Proactive Firms

1. Institutionalize liquidity planning

Leading GPs run regular exit‑readiness reviews that include buyer mapping exercises, KPI transparency (cohort‑based gross revenue retention, payback, and cash conversion), product/packaging clean‑ups, and inorganic roadmaps. Additionally, establishing trigger thresholds for ARR scale, margin, and retention can help prompt early and relationship‑oriented outreach to strategics and sponsors to institutionalize liquidity planning.

For example, Erin Duffy, Head of VC Coverage at Raymond James, stated:

“At Raymond James, we help our clients navigate a dynamic buyer base and assess a wide range of liquidity options. We emphasize the importance of focusing on the key metrics that buyers value, while also tracking alternative avenues to liquidity, so that when an opportunity arises, our clients are fully prepared to act.”

2. Strategic resource (re)allocation:

In venture, the scarcest and most valuable resource is not capital–it is time and focus. Every hour spent shepherding durable but sub-scale companies is an hour not devoted to compounding the prospects of true outliers. Proactive firms approach this challenge as a strategic reallocation of resources: by placing non-venture-scale companies with buyers who value operational consistency, often private equity. In turn, this frees team capacity to double down on the few companies where concentrated effort in go-to-market, sales, recruiting, and product development can truly accelerate growth.

3. Bridge venture and buyout operating models:

Forward‑leaning VCs help teams adopt “buyer‑ready” rhythms well before a process begins by leveraging board dashboards, building budget discipline, conducting pricing experiments, and developing an add‑on thesis. With acquisitions skewing earlier‑stage, this preparation gives buyers conviction on the operational lift and allows parties to move quickly when narrow windows open.

Why Small to Mid-Cap Private Equity Is the Natural Counterparty for VC‑Backed Software

1. Structural fit:

Durable and sub‑scale software companies, often vertical SaaS, workflow, or data analytics at$10–$50M revenue and near profitability, map neatly to buyout playbooks. This is because private equity sponsors can professionalize go‑to‑market strategy, optimize pricing, and orchestrate add‑ons to convert efficient growth into sustainable cash flow and optionality. Vlad Besprozvany, Founder and Managing Partner at Nexa Equity, says:

“At Nexa Equity, we are growth-buyout investors where we focus on partnering with high growth software companies with premium metrics. We take a true partnership approach with our CEOs, working side by side, to identify and activate the strategic and operational levers that unlock further growth and position companies to become undeniable leaders in their markets.”

2. Repeatable outcomes and flexible structures:

In markets where IPOs are intermittent and strategic M&A is selective, PE brings a flexible liquidity toolkit: majority recaps, structured minorities, carve‑outs, and sponsor‑backed combinations (such as roll‑ups or mergers of equals) that build scale ahead of a future exit. Beyond transaction structuring, PE investors often provide founders and CEOs with runway and upside to the growth plan via option refreshes, versus strategic investors that may seek leadership changes or tight integration.

Conclusion

Venture capital is evolving from its reliance on traditional exit pathways towards systematic liquidity management built on organized, repeatable actions. Dedicated roles, more sophisticated portfolio practices, and heightened LP expectations around liquidity are fueling this shift – making private equity the most likely buyer for durable, but sub-scale VC-backed software companies. Today, nearly one in four VC-backed companies will exit to a buyout sponsor, and we believe this figure will double over the next decade.1 Venture firms that embed exit readiness into their processes, build PE-sponsor relationships early, and maintain transparent LP dialogue will transform liquidity from an episodic event into a consistent engine of long‑term value creation.